B2B marketing tools: Using micro journeys to ask for buying intent

Today it's all about tools in B2B marketing and the challenges that come with them. With nearly 10,000 different solutions in marketing according to the latest MarTech Landscape, it's getting harder and harder to keep track of them all.

Studies show that companies use an infinite number of SaaS applications in marketing, especially large companies, use up to 180 different applications. There is a tool for every stage of the process, and the approach of integrating everything makes sense to avoid data silos.

However, huge integration projects often lead to IT being bogged down and missing out on important priorities. "Death by Integration."

On the other hand, there is the problem that many companies are using haphazard, isolated applications and performing "random acts of marketing" without these activities being aligned or integrated into a broader plan. "Death by Isolation."

The result is the same in both cases, you don't get to your destination. How can you separate the wheat from the chaff in this jungle of marketing tools and identify those tools that really deliver?

Midlife Entrepreneur Podcast

Subscribe to our podcast and join us on the journey through entrepreneurship

Practical experiences on lead management, product marketing and product management. Solutions from like-minded software entrepreneurs with their work-life balance stories.

Listen to the podcast, B2B Marketing Tools: Targeting Micro Journeys

The Challenge

Death by integration

For smaller companies of 50 people or more, there are already 24 different solutions in use. For large companies, there are then up to 180 different ones. That shows how complex the whole thing is. There is a single tool for each stage of the process. The approach that is usually taken with marketing technologies is to integrate everything with each other. So that the data interacts nicely and you don't have these data silos. But at the same time, that leads to most of it being bogged down with huge integration projects. This wonderful, comprehensive customer journey - that tries to cover every eventuality and in the background the tools used bring all the data together nicely - that doesn't exist. Now the IT department already has an infinitely long backlog and has been trying to integrate the CRM for two years, which will never get done.

Your priorities from your marketing tools are not top of mind. That means no tool is integrated, you can't make it live either, nothing actually happens. That's death by integration.

Death by isolation

The other extreme - nothing is integrated, you pick a small tool and commit "random Acts of Marketing" almost at random. Isolatedly trying a few Ads campaigns that land on the product page, LinkedIn Ads to your website or a post focused on "Demand Capture" - that is, targeting the ready-to-buy contacts. Further, we often see LinkedIn Sales Navigator subscriptions to drive leads or a single webinar on a topic someone just thought of, with no follow up or interaction with a thoughtful content plan. Triggered by short-term enthusiasm for a marketing tool.

Then comes the single email to contacts with the product demo or a specific offer. Individual, unrelated events that then lie in this landscape, in this Journey, but do not belong together. This leads to the result, "Death by Isolation."

The Classification of MarTech Tools

In B2B marketing, trying new marketing tools without a plan doesn't work. It takes a lot more and a lot of strategy and more continuity. How can you separate the wheat from the chaff in the jungle of all these marketing tools? What makes the tools that really bring something?

In B2B mid-market, "stuck in integration" is often a reason not to move forward. The comprehensive Customer Journey that is fully integrated with Salesforce does not exist. The CRM project is then the pretextual reason for not getting results and not pragmatically testing what can work. On the other hand, you have to realize that agencies have their hammer to hit every nail. That makes sense from the agency's perspective for more focus. Still, customization is so central to the enterprise.

With "random acts of marketing," the marketer focuses on the contacts who are ready to buy today. But the reality is you have 97-99 percent who are not in that mode. The timing is not right, are not ready to buy today. But if you ignore that segment, you're wasting your energy and you're giving up on that majority. Those 1-3 percent that are ready to buy, they're exciting, of course, but they're a lot harder, and a lot more effort and cost to find.

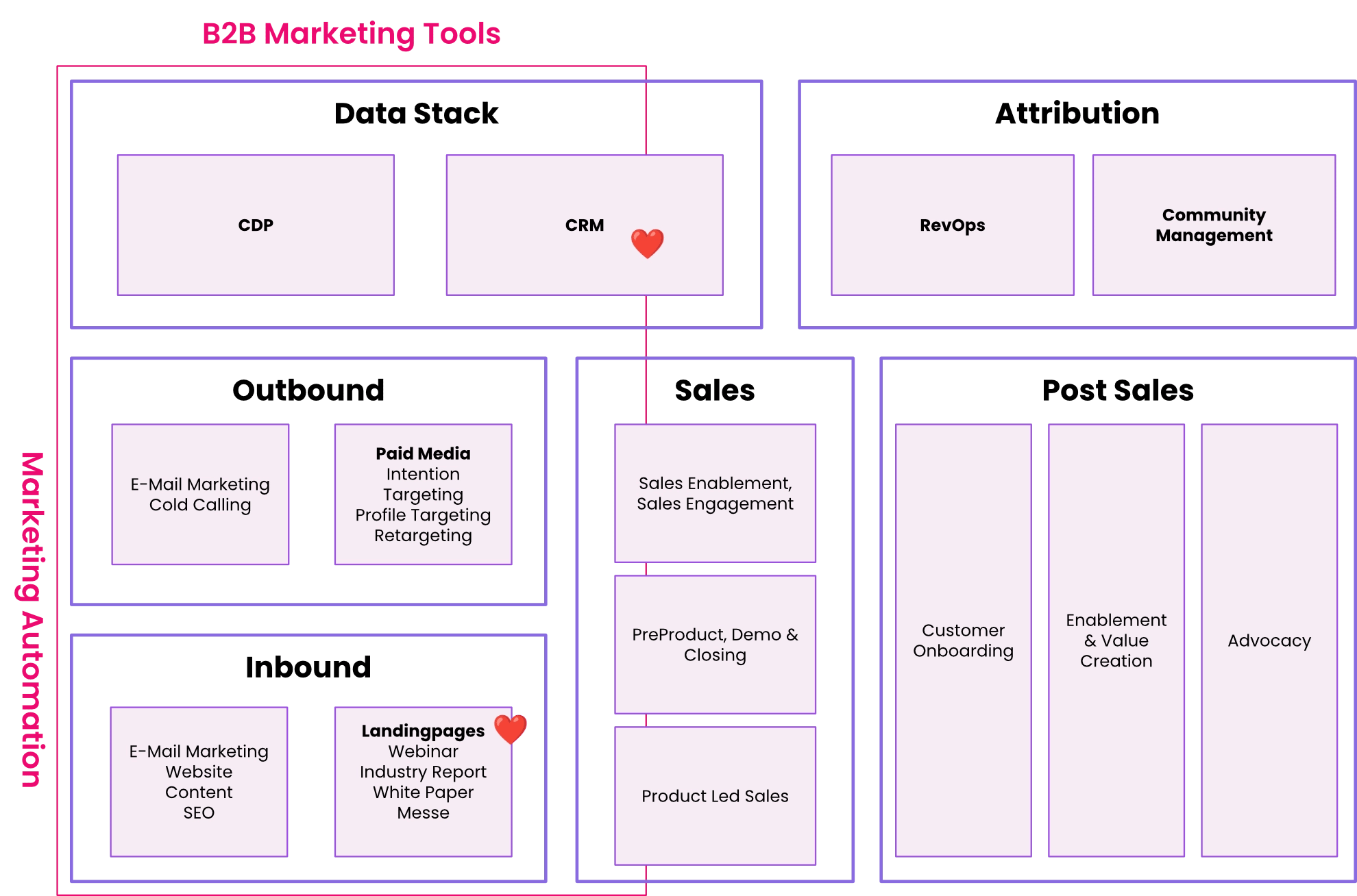

This MarTech stack has multiple dimensions.

The central core is the CRM or Customer Data Platform, where you can bring the data together.

But there is also the area of attribution, tag management or tracking that you want to map. Where does the contact come from and where does it go? Especially with long sales cycles, this is extremely complicated.

Further, there is the area of marketing automation such as with outbound mailing, inbound content strategies, SEO, building websites. Which all tie together.

And last but not least, the Sales Enablement and Sales Engagement. Marketing has the task of pre-qualifying contacts and Sales (the SDR or AE) does the meeting or closing.

Further, there are also topics, such as Product Led Sales and Post Sales. These are all huge categories or areas.

Naturally, it would now be desirable to know this fabled 360° view of contacts. That's the vision that everyone is striving for. From the B2C world, we know it even better. However, with long sales cycles, with complex products and information worlds, getting the transparent customer in B2B is much more complex. This often ends in frustration when individual activities do not achieve the goal right away.

Ready-to-buy and not-ready-to-buy contacts from the target group

Central to this is that you're not selling all the time! Planning should not be purely about closing. So don't always go for this "demand capture", this grazing what's going around. It feels like shooting into the woods with a shotgun and seeing what's left behind. It's much better to focus on the big crowd in your target gurppe that isn't ready to buy yet, but fits so well that they'll get into that mode soon. What's the best way to do that? How do you reach them?

Staying with the shotgun example, please don't shoot blindly into the forest! Build rather your delicious feeding trough, with which you attract your relevant target group. Thus, you then have the 97–99 percent. If they gather with you and consume good content from you, then you can ask them who just needs to make an investment in your area and offer help. So I focus on the 97 to 99 percent, on the majority, and casually ask them what they're willing to buy. The monster customer journey, I don't see as realistic, that takes years.

Micro Journeys instead of Customer Journeys

Instead of planning a long year for the ultimate online customer journey, it's better to plan a small Sunday trip. A micro journey, that is a trip with few touchpoints, but still focused on the automated maintenance of these contacts. The result is then probably a 180° view. Not a completely glassy customer view, but that's okay too.

Because according to the idea of "Dark Social", there are areas that you can't and don't need to track at all. When a recommendation is made, a LinkedIn post or YouTube video is consumed about your topics – that's impossible to track. I would not even try to integrate these influencers into your system landscape. Better to drive lead nurturing through automated steps.

Oracle says in a recent study, through "lead nurturing" i.e. automated nurturing with marketing automation, 450% more leads can be qualified.

What you want to achieve is “top of mind” awareness, through relevant topics. You would rather not pitch your product, you want a reason to check in with your contacts without a sales pitch. That means you want to occupy a relevant topic. You're continually providing your expertise.

What are the results from micro journeys?

For me, it would be the topic of marketing automation or product marketing. I move around this topic and I always want to produce relevant content on this myself. So creating relevance and instead of a huge customer journey rather a small Sunday trip, a micro journey. The focus is on the ominous Nurturing. I expect the following results from this:

- On the very most important and first point, today's B2B marketing is defective. It is degraded as a support function from Sales. Historically, you have the salesperson who used to do everything. Before the Internet era, you had the one who researched leads, invited to the show, "prospected," did the product demos, closed the deals. Today, that has become an interplay. But as a marketer today, you want to go so far as to qualify the lead as well, and ask if it's relevant. Then you can actively help to make sure the contact has all the information. The resulting definition of a Sales Accepted Lead – that is, a lead that completely fits in (matching lead scoring and lead grading).

- The second point is the automated maintenance of new and existing contacts. As you build your network of matching contacts, you can regularly query how they are doing in terms of readiness to buy. What is the investment in the next 12 months in the topic X? If you already have those contacts with you, or your content is being consumed, then you can collect that data as well, and so you're much more effective if you can hand that data over to the sales team. It may not be many, but those 10 are in the right audience, are ready to buy, and are on the right topic.

- The third point solves your content problem. If you need to organize relevant content to get your leads to come in and ask them too, and regularly benchmark or create industry insights from your data, you're not forced to just copy-paste content from existing data like everyone else, you're inserting your insights into your content strategy. That, to me, is the cornerstone of a “community.” You build and maintain a network of prospects with your unique content.

Example of a Micro Journey

So you should be doing lead nurturing instead of lead generation. And nurturing means focusing on your existing contacts, finding a relevant topic, and using that spanning content to keep the communication going and keep "getting them to take a little survey". Until prospects are ready to learn more - instead of just trying out any "ad hoc" features focused on closing the sale. If you don't have that yet, or are only doing "random acts" so far, how do you get there?

The following is an example of a micro journey template that has always worked for B2B companies, with the tools to go with it.

My goal is to create a micro journey that leads to a webinar. So that you can re-engage with participants and ask what they learned. For those who didn't attend, you can offer the recording, which they can watch after the fact.

Planning

First, the planning. You go in and want to define exactly your target audience and find your product positioning. There are fewer tools than relevant books I can recommend.

- One of my favorite books for product positioning is by April Dunford, "Obviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love It." It's about product positioning for technical, complex products.

- Or the book by Al Ramadan, Dave Peterson, Christopher Lochhead, Kevin Maney, "Play Bigger: how Pirates, Streamers and Innovators Create and Dominate Markets". It's about category creation and how you manage to occupy your category. To that end, this podcast, which goes a bit further with category and demand re-routing.

- Or "Loved - how to rethink marketing for tech products" by Martina Lauchengco. A product marketing book that is easy to read

- Then a slightly older book, the "The blue ocean as strategy - how to create new markets where there is no competition" by Chan Kim and Renée Mauborgne.

- And then some advertising on their own behalf. "The Automation of Marketing and Sales for B2B Entrepreneurs”, which tells exactly these positioning issues using a B2B roadmap. I wrote it together with Laura Mäder (Google) and is published by Springer Gabler.

Cool books, I can recommend them. Then we move on to messaging. We defined what the product positioning is, who is the target audience and in messaging the question is, what is the content you bring.

- That's where I find "Building a StoryBrand: Clarify Your Message So Customers Will Listen" by Donald Miller very on target.

Now I'm finally getting to the tools.

- Why not use ChatGPT from OpenAI to create the headlines? Here do not go into it further, who does not live under a stone, has already noticed a lot about this.

- Jasper is optimized for creation using AI for marketing, intros of blog articles or mail templates. It also works for images and ads. Of course, it's not about you copying it 1:1 but it's a source of inspiration which will save you time.

Then the next step is the heart of it. You want to end up with a CRM that fills up with leads ready to buy. But that's the point, you only want the ready-to-buy ones, not every noisy, even inappropriate contact in your CRM. You don't want to share those relationship building contacts with your organization (yet). That's why I see the spreadsheet or database tool as very helpful there:

Or then, if you're tech-savvy, a Custom Data Platform. The CDP, serves the purpose, like a lead database to store the contacts so that they can be provided to the necessary surrounding systems. So the master to bring together all the lead data and also record where they come from.

The CRM is originally intended to maintain the customer relationship. Mainly by the sales department. So until it's clear that the lead also fits, I don't want it in there. Firstly from the target group and secondly also from the willingness to buy.

Of course, these CRMs all also go alongside Sales, into Marketing and Service. Here, we mostly work with these CRMs for the B2B midmarket:

- HubSpot, we are also partners with this CRM

- Salesforce

- Pipedrive

- Zoho CRM

- also check the table tools mentioned earlier

With lead research, we need a source of contacts, of good quality.

- The LinkedIn Sales Navigatoris the best source in my eyes, as the data is also updated by people themselves.

Thereby, there are countless other sources that provide, among other things, contact data:

But also used technologies offer Wappalyzer or comparison platforms like G2, Capterra lead databases. Even outbound mailing tools like Apollo.io and Hunter.io offer this directly.

However, these lead databases are always just a copy of LinkedIn Sales Navigator and often outdated. All these solutions also want to enrich the contacts, with intent signals. You can see new positions there, if someone has recently changed positions, the information about the company, what industries they are in.

However, quality is the be-all and end-all of this data. That's why a dedicated lead researcher from Upwork or Fiverr or other platforms, is also highly recommended – for collecting data directly from the website from these contacts and companies with the reference clients and industries supplemented. So the terminology which is used by these accounts themselves. Also, the name of the teams and organizational structure. In the end, the words that the potential contact himself also uses are much more relevant than a summary of the categories of LinkedIn such as “Technology, Information and Internet”, which is very broad after all.

So much for planning. Define the customer group, prepare messaging, prepare contacts, and find leads.

The experiments

Now with this foundation, let's get to experimenting. We've had the most amazing experiences with an Industry Report. In order to not exactly start with a representative, scientific market research, we do a preliminary study, a micro survey and use survey software for the first survey:

- Survalyzer

- Qualtrics

- SurveyMonkey

- or even form management software such as Heyflow, Typeform or HubSpot Forms

We find relevant there that you can pass the name. So, you can pass data in the URL or you can ask for the email address. So if a contact fills out based on your email request, you also know what they clicked and filled out. Especially with the question: are you now ready to invest or do you want to push your business further in topic X? These are the obvious stepping stones. So, you have to track that.

In this preliminary study and this initial mailing to the potential target group, the added value for the recipient is very central. For that, we use the live results, which are displayed right after the micro survey. Like LinkedIn polls, you can then see what the other 520 contacts responded to right after the response. This has direct value if your contact participates. This is not the cumbersome Qualtrics format, those monster surveys that no one feels like taking. Rather, it's fun, and you see immediately – oh, others have the same problem and feel picked up. So much for a preliminary study, for micro surveys with form managers or such survey software, you already get very far.

I mentioned it before, you also have to have a handle on outbound mailing and tracking so you know who is filling out what.

- We've had good experiences with Apollo. This is also a combination of a lead database with an outbound mailing list.

- Lemlist, where you can even scrape images from the LinkedIn profiles or with company logos, you can craft screenshots together that have an extremely much higher response rate.

- Other options are Woodpecker – this is used a lot by agencies because you also have an agency mode.

- Interseller, which originally comes from recruiting.

- Hunter.io, which is also used a lot because they have a good interface.

- Or thus powerful tools like Outreach.io, Reply.io, Klenty, Outplay and Salesloft.

The last are more the massive solutions. But they all serve the same purpose. I can send an email, I can sort the leads, segment them and do personalize (at scale) outreach with follow-up afterward. Also with another email to those who did not participate. So, again I need the link tracking, I would rather not ask can you still participate, and he says he participated a long time ago.

But those who then also show an intent, I want to segment those into a separate list. Maybe save those into the CRM already. That's not so relevant at this point, as mentioned before, it's only going to be 1-3 percent that show a clear marketing signal today. You can even still keep a manual handle on that. These tools all offer native interfaces to the most popular CRMs – at the very least, though, you'll get the data out with Zapier. I would also include LinkedIn Polls in this survey. Thus, you combine posts from LinkedIn with your micro survey, supplementing the results for a more comprehensive overall view.

Besides the CRM, another centerpiece of the whole thing (are there multiple centerpieces?) is the landing page (the example from our report). This is the central point for your communication. You want to explain on the landing page, here's the survey, join how this all works and why you're doing this. Multi-step forms also lend themselves to these landing pages:

You can also put an article on it and ask how do you rate these statements. This works very well for the company DataBox. You can also have the landing page implemented alternatively withno-code or low-code platforms.

- Webflow

- Framer (impressive pagespeed)

- Squarespace

- Wix

These are tools that you can use to build a landing page super fast with lots of content. We ourselves use the HubSpot Marketing Hub for this, which then again almost offers too much flexibility. So, this way, without any code knowledge, you can efficiently build landing pages with your team that will become the centerpiece of your communication.

Now we are ready, we have conducted the first micro survey, wohoo! We managed to get first feedbacks! We are now presenting this content in a webinar. The registration for a webinar is also integrated on this landing page. We use the following webinar software:

- Demio

- Livestorm, integrates even better with Hubspot

- Luma

- Zoom

- Microsoft Teams

- or the monster community platform hopin

All specialized SaaS solutions offer easy ways to run a webinar. Additionally, it makes sense to link registrations to LinkedIn Events. This works best for us. Through LinkedIn Events, prospects can sign up with one click. The user does not leave their LinkedIn view. It has the disadvantage that many use private email to sign up. But that doesn't matter at our size. After all, we want to nurture the lead in the way that best suits them. For LinkedIn events, "Zapier" is recommended, so we can transfer the registrations directly into the webinar software, so that the participant also receives an email with the webinar details.

After the webinar, we update the landing page, turn on the recording and write to those, so a follow-up with those who attended. But also a follow up on no-shows so they can watch the recording as well. The webinar software offers these follow-ups integrated. You could make it even nicer and feed the data back into the CRM and from there create a new segment, a new list that you can then tackle again.

Scaling

The last point is scaling. Now you have really good, one-off content. You've got a webinar, you've got data collected.

The webinar is now uploaded to YouTube and transcribed beforehand. The transcription tools:

- With Swiss German, there is no perfect solution. Töggl can be used, Happyscribe is almost more accurate, but it still takes a lot of manual effort.

- For videos with written German or English languages, Descript is amazing. Not only can you transcribe videos with it, but you can also edit over the text and remove filler words. Finally, you want the subtitles for your YouTube video.

Now it's time to recycle or "repurpose" content.

You cut the YouTube clip into longer sections, two to seven minutes with subtitles, once maybe for Facebook/LinkedIn, so square, or 16:9 format for YouTube.

Then Vertical Shorts under a minute, or interactive Vertical Stories for Instagram Reels or YouTube Shorts. Or then a Webinar Summary for YouTube Shorts.

Here, in addition to Descript, Headliner is also a good help. This is the visualization of audio content: Audiograms. This is suitable for LinkedIn Posts and other visual assets. For creating LinkedIn posts from Twitter threads or distributing them on social media in general, Social Pilot provides support.

That's a lot of little helpers. In the end, however, scaling is about developing a workflow that nurtures leads and contacts. The experiments can be reused accordingly. They also served to find the right messaging and identify relevant content. Further execution of a micro survey perpetuates the same workflows, with customized content.

As a next step, we build more workflows, but we are still left with a manageable micro journey, i.e., an isolated Sunday trip instead of the monster customer journey.

Why is B2B marketing so difficult?

Now that was a comprehensive example, with lots of tools. That's fine, then we do justice to the title of this post. But it also shows why it's so difficult when this is just a micro journey that nevertheless contains so many individual steps. A well-thought-out issue with a simple webinar - but with a guarantee of success and hundreds of participants.

B2B companies in the midmarket do not have these large marketing teams, which is why it is so important to work a systematic plan, which you can also implement with 1-2 people, but focused and not after a few days to run after an ad hoc fire. Why is that so difficult?

There are three points that are often struggled with

- First, I don't know if we can call it short-term planning, it's when I hire a new person to do marketing. Often, the first result I see is a shiny new website that looks great and can also position itself really well internally. In other words, a lighthouse project in which you invest massively. But that's actually not goal-oriented at all. We don't think it makes sense to hold big workshops and make the website even more beautiful. Ultimately, there is a lack of nurturing and clear conversion of leads that are ready to buy. The vision set by the entrepreneur must set clear guidelines – only then can ownership be transferred. Don't just support the project that the person just feels comfortable with and show something that you've already done. We discussed the Clubhouse example earlier. Many people then wanted to use Clubhouse for the venture. Then you try it for three days, and then you don't have the value you were hoping for. It's a longer-term story that you start with micro journeys and then continue to tell continuously.

- The second thing I see is wrong KPIs. So false incentives that you visualize with impressive dashboards. There I see quite a lot of traffic, likes, and posts. In doing so, everyone becomes unsure because you see an activity, but you don't know at all whether it's the right people in the target group or are they really leads who then also become ready to buy. I think the traffic or number of leads as a KPI is fundamentally wrong. It doesn't have to be tracked back to the first touchpoint, either! I am convinced it has to be simpler. What good does it do me if I know that 15 months ago the contact who is currently sitting in my product demo came through this trade show? Of course, that would be nice, but at that point, I think I can then query that directly. For this, by the way, an interesting study, which shows that an own attribution even be more accurate than software attribution in B2B. I think it is much more important to define what is the story we are continuously telling and what will be the next simple goal, e.g.,: the Marketing Qualified Lead (MQL). An MQL is someone who fits the target audience. A Sales Accepted Lead (SAL), that is someone who is accepted for a sales call. So that fits, has a budget, has an authority, and is qualified by Sales. These are elementary KPIs where I would put the focus.

- This then leads to the third point. These are teams that don't work together. Separate departments that don't define together what the MQL, SAL and SQL is – those need simple, clear acceptance criteria. Those three points, and if that's true, then it fits. So, regularly working on the few but clear KPIs, valuing continuity higher and over time you see it's going up, are we doing it right or is it stagnating, do we need to change something. You have to set the vision as an entrepreneur, think long term and see that people don't get lost in the short term, in too many KPIs or discussions about definitions.

The Takeaways

Focus on automated nurturing of your contacts. So focus on that audience with small trips. But just on the 97-99 percent that fit and maybe aren't ready to buy yet, and then find out there if they have a need right now. You can query them with micro surveys and get unique insights, content and see their willingness to buy.

Comments