The GTM Strategy: Demand Re-Routing Solves Your Pipeline Problem

How to find prospects and leads who are ready to buy. How does it work and how doesn't it work? Companies are always in one of two modes. Either they don't want to buy right now because the timing isn't right, because they don't have a budget right now, because they just did a huge project - or they do want to buy and are in the typical product comparison process.

The go-to-market strategy or how to find customers on the Internet

You get a spreadsheet of 1000 requirements via an RFP, for instance, where you can't meet half of them or need additional development. These requirements are actually written for the market leader or the category leader. So the best or most known solution from an area, a category. This is not you in B2B Midmarket! You do not want to end up in such a product comparison, where you do not stand out perfectly next to all the others. Alternatively, you would then have to be cheaper. These Request for Proposal (RFP), RFP and Tender are a very tedious process when companies are just in the mode of wanting to buy. Today in our topic we are talking about the typical B2B SaaS sales strategy for mid-sized companies. How this can work and how to stop depending on it when the RFP is made. How does this even work and how do we classify it? What's right and what's wrong? That's what we should be explaining now in the podcast.

What's the problem with today's go-to-market strategy? What are some of the typical mistakes?

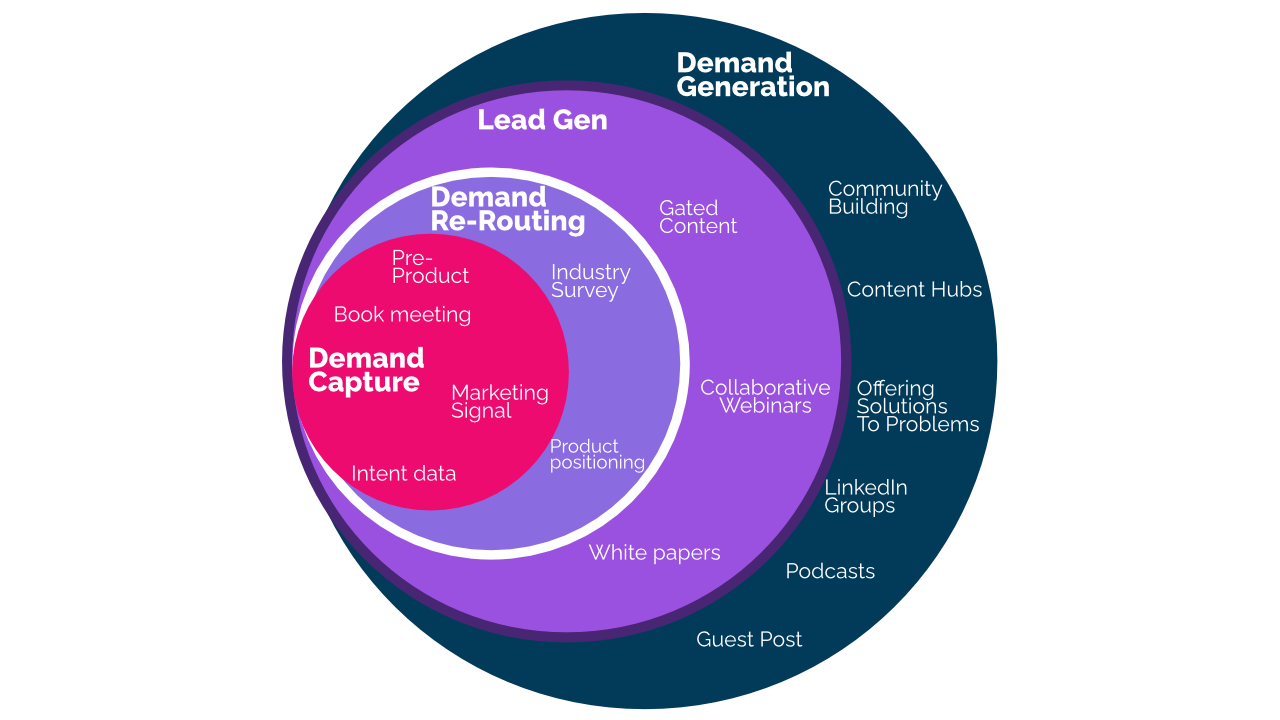

Modern B2B marketing is about two functions: Function 1 is lead generation, which Function 2 is lead nurturing, where the goal is to nurture an existing lead and lead it to purchase. Let's stick with lead generation.

Practical experience on lead management, product marketing and product management. Solutions from like-minded software entrepreneurs with their work-life balance stories. Take off your hero cape and join us

The problem with lead generation

The problem there is that it usually doesn't work or is really expensive. We see haphazard, ineffective marketing campaigns, ad-hoc marketing experiments, and money wasted on agencies and software. Most of the time there is no holistic plan behind it either. Concrete examples are ventures that collect email addresses. By fishing with dynamite. So they spend a lot of money, on keywords or on LinkedIn, to find the leads, which then download their e-paper. But if you look closely, it's not working. It's the wrong leads. They are students or someone from the competition. Very few that really fit your target segment. Spear-fishing would be much better, while you have a very clear target group. We also always go to SaaStr, the conference for SaaS companies. We see there at every keynote, it's always about whether you know your clear target audience. What is your Ideal Customer Profile (ICP), your Buyer Persona? It's the key element every time. What we also see that in B2C there is a trend to get as much traffic as possible. In B2B, the opposite is true. Like a surgeon, you have to cut out exactly that, the fillet piece, which you need exactly. That's the only focus. Another example of what we see is this huge branding workshop, which is all about positioning, culture, values. That's all well and good, but the result is usually just a website that is supposed to fix everything and solve all the problems. In the end, however, there is no systematic process behind it and the leads convert. But it is then simply a beautiful new website. What we also know from "Mansplaining" we also recognize with the Ads. We call this "Adsplaning", where you try to explain the world. That's right, that's wrong. Instead of developing messaging on your value add that also clearly differentiates what the value is from your solution and also helps solve the problem statement.

The Problem of Lead Nurturing

Then comes the second function, lead nurturing. This is mostly annoying, so the typical sales goes and asks for "hey, do you want to buy, do you want to buy now, or do you want to buy maybe in a month?". Instead of this supporting the process and asking if you can help in the decision. An example of this is when you're at a trade show. You collect 100 business cards and then you send an email to those 100 contacts saying "hey cool you were there, now buy!". Of course very few want to buy that now, as Valentin said before, it's 1 or 0, we are strong advocates of getting the timing right. It's also difficult to find an attribution model that can assign over the long sales cycles that now the one comes with the right intention. That's now the metric where I know exactly, "okay, now he's ready, and I need to reach out." Or you have a lot of leads, but they end up buying the market leader because the product comparison was the focus and the comparability on G2, Capterra, or on Gartner's Magic Quadrant. There you usually lose if you are not the category leader. Then in the product comparison conversation, you still have to lower the price and discount to sell at all.

So you are explaining a typical problem that has been omnipresent in the last couple of years. Lead generation, with the understanding that you're getting ready-to-buy leads that you can pull the trigger on right away. It's insanely expensive and you can't build it efficiently. Nor is the fabled lead nurturing, where you drive existing leads forward, technically possible at all. It results in you getting an email or a call every few weeks asking if you want to buy now and just being annoying, what works now? What's better?

We built a company to perfect lead nurturing and realized how difficult that it really is. We came to the conclusion that lead generation is better replaced, by demand generation.

Demand re-routing solves your pipeline problem

So one is aware, there is no intention. One is aware there are 97% to 99% in the market where the timing is not right that are 0 and not interested in buying now. But we can create awareness of the problem. We can position ourselves as a company with the right target audience and we can use the LinkedIn, Google, Facebook channels to frame the problem, which is in the market, for our company. So we can provide answers or discussions around the topic. A clear target audience, in a clear category, do small and agile experiments to find a right messaging. We don't try to educate them all, with "this is wrong and this is right", but communicate the differentiation and the added value. In the second function in lead nurturing, there we know that only 1% to 3% are just ready to buy, so status 1. So have an intention to buy. We are already "top-of-mind" and present through the demand generation. We also know that the process of: downloading an e-book and then emailing a follow up saying, buy now," that that doesn't work.

This is where a pre-product comes in handy, the pre-product, as we also call it. It is suitable for summarizing the offer that it becomes much easier to understand it. This can be an audit or a workshop and that is a ticket to then also build up the trust and finally just bring about a decision, without a product comparison.

But that still sounds abstract now. I would therefore like to connect these two functions of B2B marketing, with a third function. We'll call the connecting element "Demand Re-Routing."

You have to think of it this way: You're clearly positioned in an industry in a category. And we see that right, that you go into the category, that you go into the CRM category, for example. There's an event happening, you go there. But you go there with the message that the problem that's being discussed here, there are other possible solutions. We want to show the gap that exists from the problem to the solution in this category. That is, to show solutions that are newer or that go the other way, that your solution, your product also goes. The result is: you don't have a sales pitch, you show the gap and instead of screaming "take me, take me" you show a path that would probably work better for you. "I meant I actually want X to solve my problem, but you've now shown me that I actually need Y, can we look at that together in more detail."

Instead of lead generation, I do demand generation so I can position myself without coming across as aggressive when I want to find prospects. Instead of Lead Nurturing, I do Demand Capturing, for those who are ready to buy, who can then more easily buy a pre-product. And Demand Re-Routing I understand as if I'm in a hip bar with quite a few people in it and next door is actually the cooler bar with better music and better drinks. I'd rather go there because it's less crowded and easier to meet people (and there's less competition). But then I still go to the crowded bar and point out to people that it's actually better next door. Do you have some practical examples of how I can think of this?

That's exactly what I find good example with this party. There is a generic bike example. Nobody was looking for an e-bike when the moment came when the category went through the roof. But the e-bikes positioned themselves in the bike category and then everyone saw how fast that one was going away and that it was still sporting. So then the electric bike category solidified.

Practical examples

A well-known example that happened a few years ago is Salesforce. They said you need a CRM, but what you actually really need is not the software that you install, this on-premise software, but you need a cloud CRM, which is the new way. As you can obviously see, that has worked reliably.

Another example from a company we know from our environment is Certifaction. They do e-signatures, but they say it's about sensitive data, then it has to be privacy-first, and the big market contender DocuSign can't justify that accordingly with equal depth.

Or Xorlab, they position themselves in the cybersecurity space and say that cybersecurity has the problem that most threads, most attacks come through email. So you need an email security solution so you can maintain your cybersecurity.

One example we know from before is Bexio, which positioned itself, as an accounting solution. At the time, Bexio wasn't really an accounting software at all, but a business administration solution. But has chosen the path of positioning itself in this category via accounting.

Or an e-commerce agency that says you don't need a new store. The store you are looking for predominantly implies a huge effort in the operation, in the digitization of these processes and in the maintenance. You need something where the downstream can solve.

Or for our example, we had a solution for marketing automation and we said you need a systematic lead management process.

As a final example, you know from the vacation destinations. The end customer wants a guest card. But the vacation destinations may see more of a CRM that can offer a customer experience across the entire journey. But they still don't position themselves CRM solution, they say, here you have your guest card. They address the loyalty problem, which they really want to solve, by building guest cards into a loyalty solution.

So explaining the differentiating factors, where the existing party is running and doing that very consistently.

The process of GTM strategy

Now that sounds excellent in theory: demand generation, demand capture, and demand re-routing, but how do I get there now, what does the process look like?

The process takes 6 months. You have the advantage of being small and agile. You can focus on a few experiments that way.

Phase 1: Planning

The first phase for the first 2 months: it's all about analysis and planning. You take your existing customers, you look at the potential: Which customers are happy? What is their pain point? Which of these customers have a common industry? You try to find the commonality, a cluster where you know there are more, similar leads. Then you look at the competition. That's not as central, but it still helps you in product positioning and messaging to crystallize your unique selling proposition for your demand re-routing strategy. As a last point within the planning I see a pre-product, which you can develop to get easier access to the customer, who can buy the pre-product e. for example for CHF 5'000 to 10'000. This is the ticket to building trust.

Phase 2: Experiments

In Phase 2 from Months 3 to 4, you'll run experiments. In this second phase, you test your messaging with posts on LinkedIn and outbound mailings. You're testing your first attempts with your audience. Are there positive signals, are there comments, or is there a request for the preliminary product.

Then, importantly, if you then have product demos, be sure to ask where the prospect is coming from. That allows you to do away with a complex attribution model. You ask, where are you originally coming from? What was it that worked? Was it the LinkedIn post, or did you find here organically?

Phase 3: Scaling

Phase 3, from month 5 and 6, do what worked more and try to bring a repeatability to it. You build your content strategy around the topic you're positioned on now and build out your existing experiments. Then you have initial flows, which you've gone through. Maybe you've tested webinars, and then chunk it up into new posts, and then do that flow again every month, bringing in repeatability.

This 3 step process, sounds but also a little elaborate and needs yes a little longer. Like you say 6 months. The reality is yes everyone wants to see results. Investors ask how you're selling and your employees want to see it moving forward. Even your partner is thinking, when is this going to take off. How do you handle that situation of not being able to produce results as quickly?

There's a lot of pressure on you because you can't actually influence the results. But only delayed, after about 6 months you can just show, look here, there we have the first clear statement that it works. That means, in the end, it's an extreme will to persevere, but also a bit of ego and managing yourself. We have to go through it continuously. We have to do the tests systematically and also question ourselves weekly whether I am implementing it correctly and consistently. Maybe also talk to the co-founder about it and explain it. We see that it's going in the right direction, but the right numbers, I don't have them until we get clear statements and our deal pipeline fills up.

The Key Takeaways

So you have to communicate expectation management that your people understand. And set a plan so you know you're doing the right activities. And you need a way to manage that pressure. You don't even start to measure the results in detail because that would drag you down. So what are the key takeaways on how I can have a successful go-to-market strategy as a B2B SaaS.

My claim is Demand re-routing solves your pipeline problem. You manage to not get into a sales conversation where you say take me and please a little cheaper. No, you help with the education that shows the gap, from the market as it is today and from the problem your prospects have. Towards the solution path that you may also consider. Does that fit for you, yes or maybe not. That's then a clear decision you can make there.

Thus you move away from:- how much traffic do I have?

- the definition of an MQL?

- and how many meetings booked?

It's all getting easier, it's measured along the customer journey, goal oriented, but most importantly focusing on how many relevant prospects do I have in the pipeline that really need to solve a problem as well.

What I also see as important, the product positioning needs a bit of courage. Courage to take a gap. Then it takes that period of time where you have to manage yourself and manage the team. What also helps is the pre-product to take the hurdle down a little bit because it's so difficult to get the complex software bought. It's a way to show that the audit or the workshop, which is upstream, is being purchased.

Finally still manage yourself that you give yourself the 6 months and try to measure the activities and classify them correctly. So predominantly the staying power continuously implement the whole thing, with the team - and motivate your team to do so - that this also comes good.

Comments