B2B lead generation: find ready-to-buy customers with Industry Reports

Lead generation in B2B is complex, expensive and almost never works. The typical problems why messaging doesn't resonate are wrong timing, no relevance and lack of trust. However, there is a reliable solution to identify the 1-3% right leads with buying intent: just ask them about it!

How the Industry Report has proven effective for direct data collection of zero-party data and relevant marketing signals

Every B2B company - whether agency, software or software-as-a-service (SaaS) - all want leads. The more, the better. The problem with that, most leads aren't interested in their product offerings.

As mentioned in previous podcast, it's hard to get the timing right. Only 1 to 3% of B2B leads are ready to buy, the other 97 to 99% don't want to buy anything right now - no matter how good your sales email is, they can't be convinced.

How do you make your contacts reveal what they want to buy and when! The solution is simple and has worked reliably for us? You ask your contacts directly in industry surveys. You get zero-party data as a result. Your contacts tell you what they like and when they are willing to spend money on it.

.Mostly it's about false intent signals or no signals at all about intent / willingness to buy for companies in the B2B midmarket. Because vendors have little reliable data on midmarket companies as they do for enterprise companies, with Albacross, Lead Forensics, SalesViewer, Clearbit, G2, Capterra, ZoomInfoor Cognism. These providers tell you when your target audience might be ready to make a purchase.

Further, the wrong dimensions are predominantly positioned at the customer. When you get the comparison table with a Request for Proposal (RFP), it has the wrong criteria in it. Dimensions that are not relevant for the segment you are positioned in. The category leader has already positioned themselves and already set the criteria.

Midlife Entrepreneur Podcast

Subscribe to our podcast and join us on the journey through entrepreneurship

Practical experiences on lead management, product marketing and product management. Solutions from like-minded software entrepreneurs with their work-life balance stories.

Listen to the podcast, B2B lead generation: finding ready-to-buy customers with Industry Reports

By industry surveys, on the other hand, your contacts tell you what they like and when they're willing to spend money on it. This is different from first-party data, where you observe when they are on your website or submit forms. Further, there is the so-called third-party data, which other companies your leads have registered with. These are the infamous third party cookies, which are being used less and less these days.

The three problems with finding leads that are ready to buy

We collect data by creating Industry Reports. We'll show you what that process looks like for a report. As the publisher of the Marketing Automation Report, we partnered with ZHAW to tackle the right B2B midmarket contacts. With research partners and sponsors, we were even able to increase our reach. Why is it so difficult to find leads that want to buy, Marc?

Wrong timing ☠️

You say it right, figuring out the right timing is a big problem. Everyone wants leads. Lead generation is the top goal of B2B companies, but most of the time people forget that the timing has to be right. It is much more important tofirstly know the readiness to buy and/or secondly always stay "top-of-mind".

Identification of willingness to buy

Regarding purchase readiness identification, you need clear signals. You want to know what marketing signals are occurring along from your customer journey. To measure this and evaluate the data, you need comprehensive attribution models and, if necessary, expensive customer data platforms. For example, if a lead is browsing your website, they will slowly move from informative content to pricing, to product specifications, until they book a product demo. If he doesn't take the latter step and doesn't book a demo, then you need lead scoring to identify who has progressed and how far.

As a company "top-of-mind" with your customers

If you are "top-of-mind" as a business, it would be ideal if this person contacted you. Because he is looking for a solution at just the right moment, has a problem and wants to talk to you. However, that requires a well thought-out content strategy, follow-through, and consistent messaging. Your product positioning also needs to be clear. You can't keep asking "do you want to buy now?", you play out your relevant content and it has to be just top notch. In such a way that the recipient doesn't get annoyed. Then we would already be at the next problem.

Not Relevant Content ☠️

Content that is not relevant. That sucks, especially with complex buying processes and long sales cycles. Even with lots of competition for keywords. Your emails are quickly identified as a spam or your website arrives as a poorly written product advertisement - with no deep content or personality!

Superficial content

So less and less insights, no in-depth research and boring data that has already been published 100 times. No one is writing good content anymore! No new data is collected and daring, "edgy" results are brought - which, on the other hand, an entrepreneur with a lot of experience could bring across as an expert

Missing personality

Most of the time, personality is also lacking. It sounds cribbed and the AI-generated sentences don't bring that "unique content." This only results in the copy-and-paste ChatGPT whitepaper that nobody cares about. Neither Google nor your target audience.

Missing trust ☠️

The final problem is lack of trust. You need reach, but your countless sales emails are being received in the one-size-fits-all gobbledygook category. These emails end up at the in the minds of your target audience, built-in spam filters and are deleted.

Your target audience doesn't know you as the sender

You don't have a relationship with these leads yet, and you haven't brought any value. So the email with those subject lines like "Quick Question", "Meet for coffee", that doesn't work.

Zero Value and that equals Zero Trust

Further, you have super much noise around your subject. Offering a software for X, an outsourcing solution for Y, 1000 leads which are offered to you or "do you have capacity for new customer inquiries" - all this is recognized as noise about nothing.

The Solution by Industry Reports

You mention the three biggest problems:

- Figuring out timing, when is the right time

- Relevance, that it just doesn't sound "salesy", boring and annoying

- Gain trust with the appropriate target audience

How can you solve these problems? What's the way that works?

Following learnings - using our Industry Report as an example we have seen that collected benchmarks of an industry are very helpful

Data Collection & Timing

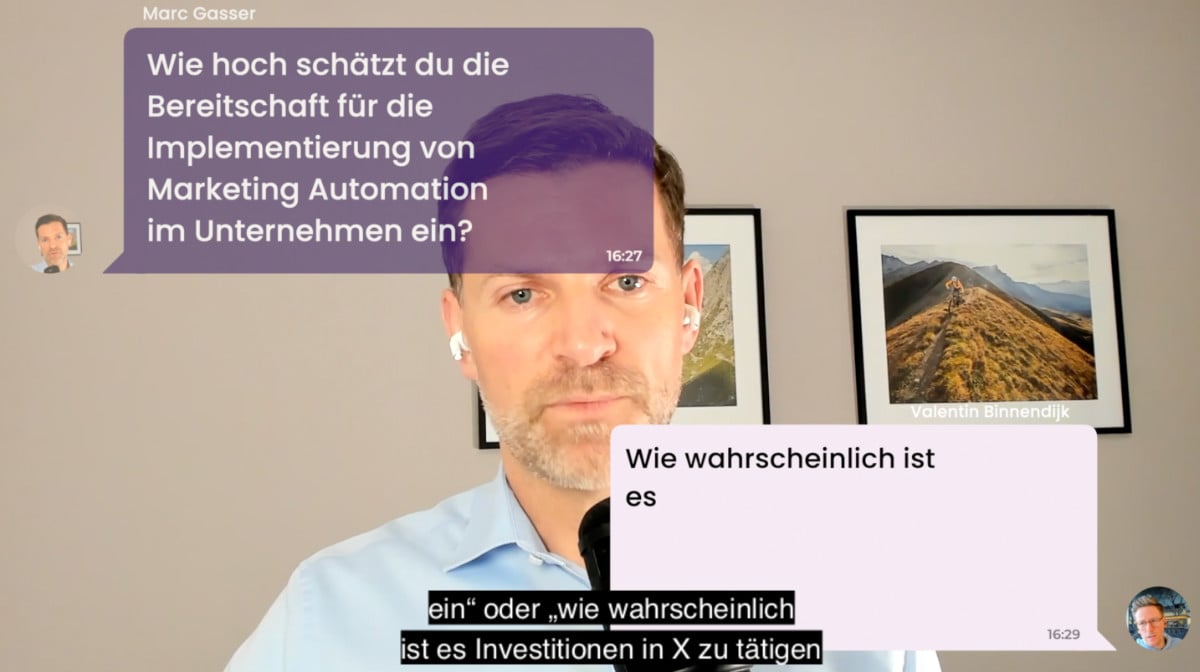

With timing, we would need to analyze intent signals. Why not actually query? In the B2B midmarket, intent databases are difficult to find. For companies that are not listed on the stock exchange, you can just about get data such as new positions that have been filled, financing rounds that have been completed, press releases or the last LinkedIn post. That's good, but it's much more important to ask for buyer intent directly, so you get zero-party data with your industry survey. Directly from your buyer persona. Such as through the questions

"how high do you rate your readiness for implementing marketing automation in your company"

or

"how likely is it to make investments in X in the next 12 months"

To stay "top-of-mind" then, you need continuous material, continuous super content, with which you can bring 5 to 10 touchpoints spread over the year and still not annoy and deliver value. So you need a theme to be relevant.

Relationship & Relevance

About regularly contacting relevant content, you build a relationship. You take a topic that your buyer persona finds important and just not you as a business. This is not the ERP integration you think is so great or the process you offer! It has to be relevant to the person who receives it. What is the priority for this buyer persona? The most important topic that year. That's your hook in your Industry Report. An example would be "AI and customer portals to save you time", "E-commerce automation for a continuous customer journey". That's your hero content strategy! This has this theme as a hook. What we also see is that goals are not set properly in the enterprise. An organization that nails employees to goals, like number of leads or traffic to your website. That doesn't make sense. It would be more important to measure the relevant target audience. Which Buyer Persona or Ideal Customer Profile (ICP) shows engagement and researches quality, relevant content? This content should then also be distributed on an ongoing basis, and regularity is evaluated, not the number of leads or traffic.

Value & Trust

The trust point is about rewards and authentic messaging. Your audience is already inundated with "sneaky" content. Think like an FBI agent who wants to elicit information from a stranger and then rewards them accordingly

Tell those you want to fill out your survey what you want from them and what they'll get in return.

- They get the benchmark when they fill out the survey, they see live results of the other companies that participated.

- You can also position yourself as a company in the report by submitting a statement or testimonial. They get a backlink and are published on the website and in the report. This works great and is often requested.

- You can then offer VIP access andsend earlier access to the evaluationto participants.

- The target audience needs support and you provide the learnings. This is a competitive advantage and your contact can set themselves apart from their peers, with better market positioning.

Finally, it helps to build trust through a suitable partner. If your name is not Apple, you need trust from an official body with scientific character. An educational institute that also fits your target audience. But even then you need a solid survey design. It must not be too theoretical and it needs the dimensions that help your company to position itself. So you do not take over the dimensions set by an enterprise company.

10 Touchpoints with Leads Without Being Annoying

This sounds exciting, meaning I do a survey with a trusted partner who knows the target audience. The target audience has to want to engage with it. So a relevant topic that really interests them. This may well be "Metaverse" or "Artificial Intelligence" - so I can constantly ask. I want 5 to 10 touchpoints per year. What are the tricks there or what are cool touchpoints so you don't get annoying and your contact thinks to himself, now Marc is writing again. What are your recommendations that work. What actions have proven successful?

As the publisher of the study, you want a way to approach customers on a regular basis. You put info in bites and provide rewards. That's how you build trust.

A concrete example of what the process might look like:

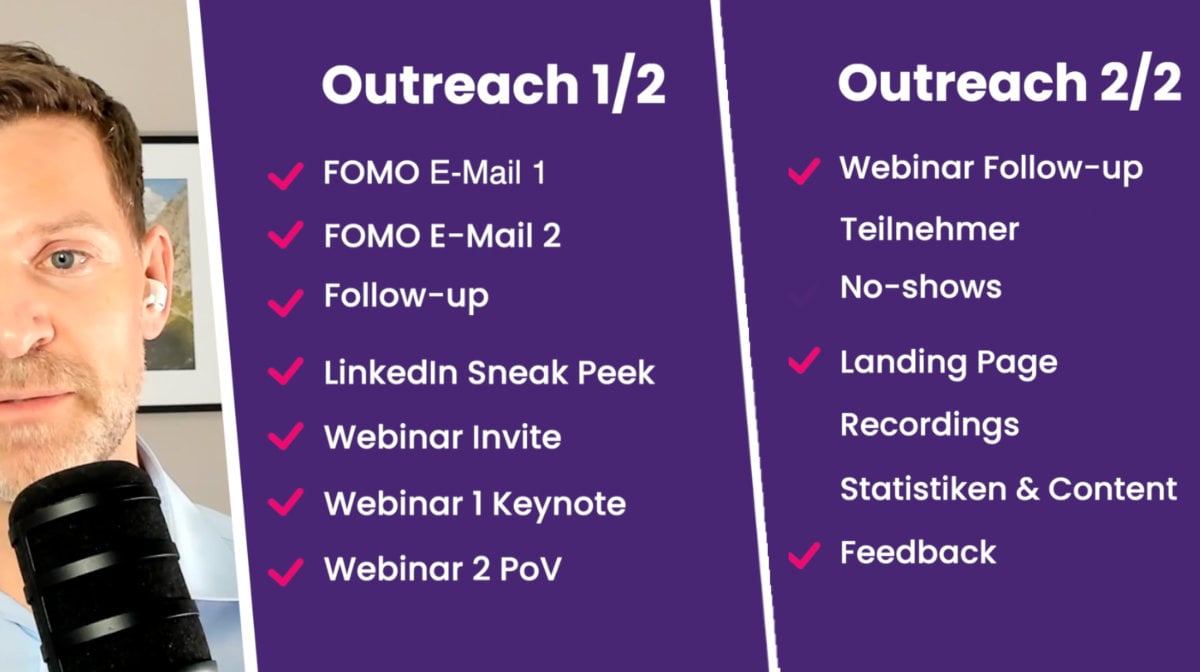

- 💌 You send an initial email, a survey, which you send to your best customers. "Your company in the Marketing Automation Report 2023", so you create a FOMO - a "Fear of missing out", that's the effect when you suddenly feel there might be something important you're missing if you're not there. You also solicit feedback from your customers. Is it the right audience? Are they relevant questions? Is the respondent learning as they complete the survey? Then you adjust the survey again.

- 💌 On top of that, you go with your FOMO email to your leads that are top researched and manually enriched. You need to reach a clear target audience. You ask if they can participate and offer above assets for it.

- 💌 After a few weeks you share first survey results and report with them in a follow-up. You show the first learnings through the answers of other participants and underline that you really want to have the contact with you. If the fits into the target group, his details are super important.

- 📊 With these initial results, you also publish a LinkedIn post, a "sneak peek" and package and visualize in it, the value of a survey participation.

- 🎪 On top of that you invite to a webinar, about in four weeks, in which you announce the results together with the research institute. You also publicize the info through a LinkedIn event and combine the interim results with the event invitation.

- 💌 Before the publication of the study, with this event, you approach the participants who have already participated and reward them with the first information, which they may already look at - the first evaluations.

- 🍿 At the webinar with the date X, you offer a crisp summaries and announce further webinars with partners that highlight a different Point of View (POV). This way you show other approaches in the topic.

- 💌 After the webinar comes the next follow-up. To the participants you send a summary and the recording. To the contacts who did not attend, you also send a follow-up with a summary and the recording, only slightly reworded.

- 📊 Finally, you lead the prospects to a sexy landing page with your publication, the published stats and complementary content like testimonials and more information from the survey.

- 💬 There's then the option of co-creation - you ask for feedback for the next edition of the Marketing Automation Report. Did it help you? Where would you want to expand the topics or reduce them?

That would already be about 10 touchpoints to reach leads with value and not annoy them.

Choose a relevant survey, ask for the right timing and find a trustworthy partner. Now the thing about B2B is that it's often, "My industry is special, my customers are very different. Of course, it doesn't work there. We have to do it differently." What is there our experience, do you have examples that we have already implemented or met, which also worked so well?

- I mentioned the Marketing Automation Report with ZHAW, where we had the buyer persona "Head of Marketing in B2B Midmarket". We were able to build a huge network and tackle the hidden champions in the DACH region. I was able to pass on value and create an exchange that was very valuable.

- Another example is Databox, a dashboard with visualizations. It brings together data from various interfaces. They tackle agency CMOs and create benchmark reports on a regular basis. To do this, they create a lot of content through mini-surveys. With every article that is published, this involves up to eight people who improve the article and really give inputs there through these surveys.

- Startups.ch put out an award, with a contest, a jury, press releases and have gotten an extremely large response in their market. Above all, they came so to buseinessplans that have been submitted by founders and so acquired customers.

- TrekkSoft have issued a "Travel Trend Report", for the owners of tour operator companies and so analyzed the market and made them aware that they occupy this topic.

- Frontify, has conducted brand management studies with Forrester and so caught the brand managers in the enterprise segment

- Unic, a large agency, publishes a benchmarking of customer portals at health insurance companies and repeats this annually. This has attracted the few, but the right people, from health insurance companies.

- Then there's the Commerce Report by DataTrans with FHNW or the Online Retailer Survey by ZHAW.

These are all examples where what comes through is that a relevant topic generates very unique, new content. Your collected data from this audience, you ask - not just once, but annually or even more regularly.

The effort

This sounds like a huge amount of work. I have to create 20 touchpoints, pick out the right and relevant topics, implement a study design, then write to all the contacts, do research, follow up again and again, and convince the right partner. Where do I even begin?

It sounds like a lot of effort, but...

- The effort is primarily to find a research institute that suits you and can scientifically pull off the project with you.

- Then build partnerships and a network, which have the same target audience and an advantage, from this valuable publication.

- You need to approach the survey design with the right dimensions - with the criteria that fit you with your experience.

- You spread it across inbound and outbound.

- You need "end-to-end tracking", an attribution model to make sure the right people get an email and those who have already filled out the survey don't get nagged.

- Then the evaluation, analysis.

- And finally get the publication and feedback.

- But then you hit the repeat button and you do the same thing again, but much more effectively.

You build yourself a Hero Machine, a flywheel that you slowly roll on and become much more effective year after year. You build a brand, position yourself, and create a continuous process.

- You then know exactly what content piece you need to bring because you derive and recycle everything from that hero content. You can publish intermediate results on an ongoing basis.

- You know the unique intent signals, the willingness to buy of your target audience, because your contacts respond directly when you ask them what they're investing in X over the next 12 months. You find the leads who want to buy.

- From this, you build long-term, sustainable relationships with your partners, with the research institute, and most importantly with your contacts through your positioning.

How do you start?

Wow, now that's a plan! However, you are a book author, Innosuisse expert, co-founded a study program with ZHAW, were Lecturer at HWZ and have already written articles in Handelszeitung, etc. and then a podcast with me. That helps, of course, to get a good study partner. But as a normal entrepreneur, who is at the beginning or just took care of the business and worked a lot - then you face the problem that you have no money and no brand and nobody, with a big known name like a top university, wants to work with you. Where do you start then?

Bootstrapping or buying speed

Either: "Start small, scale up"- in our case, it was a master's thesis five years ago, with which we did a preliminary study on the Marketing Automation Report. We did this pretty much on our own with no budget. We invested a lot of time, but it forced us to be innovative and choose a topic that interested.

Or: if you want to get there faster - you look for allies. In addition to the educational institute, which quickly costs CHF 20k to 30k for the implementation, you bring in scientific partners who cross-subsidize the whole thing. These are sponsors who have the same target group and invest CHF 5k to 10k. If you have these sponsors on board, with the same target group, they can also position themselves and can address their network. So they have solved their content problem and get really good content. They can bring in their point-of-view (PoV) and it helps you to get a lot of reach. In the end, it also lends itself to a media partner who gets to exclusively publish the results.

The success factors

Cool, as always there are two ways. Option 1 is bootstrapping, then it takes longer but need less cash and rather can implement myself. Option 2 is, I buy speed as if I am going with a startup to get investors and can get the solution on the ground with more horsepower. So what are the takeaways, the typical stumbling blocks, that it becomes a hit and not a pipe burst?

Build relationships with a long-term goal and figure out when your contacts need your help and you can solve their problem - then when the timing is right.

What are the success factors? You need a response from many survey participants, so a high "response rate" is essential for you.

- Your survey must be sexy, so really crisp and short survey design. Scientific, of course, but also simple! We have good experience with a conversation mode, a kind of chat history, which can be answered easily and "on-the-fly" on a mobile.

- You need relevant, in-depth data and ask about it, with questions that relate to a previous answer.

- You need a innovative topic, which is not ERP integration - not meant to be a company, but really a recipient.

- It has to be personally shipped, it has to sound like you. It needs to be at eye level.

- Then it needs comprehensive lead research with enriched data, so with data that really appeal to the recipient and have been accurately revised. Accordingly, the conversion is then higher.

- The survey can also be representative in your segment. If you choose a very specific target group, have the right contacts, then I would ask the desired candidates even more personally and separately: "Would you participate and may I mention you that you have participated. The data is anonymized, but would be cool to share that you participated."

- Finally, you need a solid presence for the presentation of the results with a informative landing page with the crisp statements where the experts position themselves and show how relevant it is.

- You only need one hero content piece. You don't have to be the Avengers, with lots of Heroes, you just pick one of those characters - that's just your Hero theme. Then you derive all activities from that theme. That's your content strategy, your product positioning, your messaging - all derived from your Hero.

Comments